Did you know that families without tax-smart wealth transfer planning risk losing up to 40% of their estate to taxes? This eye-opening figure makes it clear: tax-efficient wealth transfer isn’t just for the ultra-wealthy—it’s an essential practice for anyone hoping to leave a meaningful legacy. This guide unpacks proven strategies and essential tips to help you keep more of your hard-earned money in your family where it belongs.

Opening Insights: Why Tax-Efficient Wealth Transfer Matters More Than Ever

In recent years, changes to tax law and shifting economic conditions have made tax-efficient wealth transfer a vital topic for families and individuals alike. Estate tax rules are continually evolving, and the potential for increased tax liabilities means that being proactive is more important than ever. Without a clear plan for wealth transfer, assets can be significantly depleted by gift tax, estate tax, and transfer tax. Proper planning—through trusts, annual gifts, and updated documentation—can minimize or even avoid these burdens.

High net-worth families aren’t the only ones that can benefit. Anyone with property, investment assets, or a business should understand the risks of unplanned estate taxes and the opportunities provided by modern estate planning. If you want to ensure you’re passing on a legacy and not a tax bill, start by learning the basics—and the advanced strategies—of tax-efficient wealth transfer.

"On average, families could lose up to 40% of their estate to taxes without proper planning—a staggering number that underscores the importance of tax-efficient wealth transfer."

What You'll Learn in This Tax-Efficient Wealth Transfer Guide

- Core principles of tax-efficient wealth transfer

- How tax law shapes estate tax burdens

- Essential tools: revocable trust, irrevocable trust, and grantor trust

- Strategies for minimizing gift, estate, and transfer tax

- Transferring wealth among generations with minimal tax impact

- Expert tips for ongoing wealth planning

Understanding Tax-Efficient Wealth Transfer Basics

Tax-efficient wealth transfer refers to a series of coordinated strategies and planning techniques that reduce or eliminate unnecessary taxes as you pass assets from one generation to the next. It’s a cornerstone of wealth planning and is essential for individuals at every asset level. By creating an estate plan that prioritizes tax efficiency—through smart use of trusts, gifting strategies, and adherence to current tax law—you dramatically increase your family’s chance of preserving your wealth.

Without such planning, a significant chunk of your assets could be siphoned away by the IRS through estate taxes, gift taxes, and other transfer taxes. Professional estate planning integrates each of these elements and tailors them to your unique wealth, family needs, and goals—with the ultimate purpose of minimizing tax burden while maximizing inheritance and charitable impact.

The Role of Wealth Transfer in Financial and Estate Planning

Wealth transfer isn’t simply about moving money; it’s about orchestrating a legacy. Integrating tax efficiency into your estate and wealth planning ensures that your assets are passed along with minimal legal and financial friction. By accounting for factors like income tax, property values, business interests, and family needs, your estate plan can deliver security and flexibility to your heirs.

A well-structured plan leverages tax advantages, such as the annual gift tax exclusion and lifetime gift allowances, and harnesses vehicles like revocable trusts and irrevocable trusts. These tools enable you to minimize your taxable estate, address unique family circumstances, and prepare for any changes in tax law. The result: your loved ones receive their inheritance efficiently and with greatly reduced tax liability.

Key Tax Law Concepts in Transferring Wealth

Navigating tax law is central to tax-efficient wealth transfer. The federal estate tax, gift tax, and the generation-skipping transfer tax each have unique thresholds and exclusions. Understanding the estate tax exemption amount, current gift tax exclusion limits, and which transfers are taxable is essential for designing an effective estate plan.

Many families are caught off-guard by how estate tax and other transfer taxes are calculated. For example, the federal estate tax can apply to estates above a certain value, and different states have their own rates and exemptions. These rules—alongside strategies such as life insurance, annuity trusts, and the precise structuring of grantor trusts—form the backbone of efficient wealth transfer and lasting financial security for future generations.

Estate Tax: How It Impacts Tax-Efficient Wealth Transfer

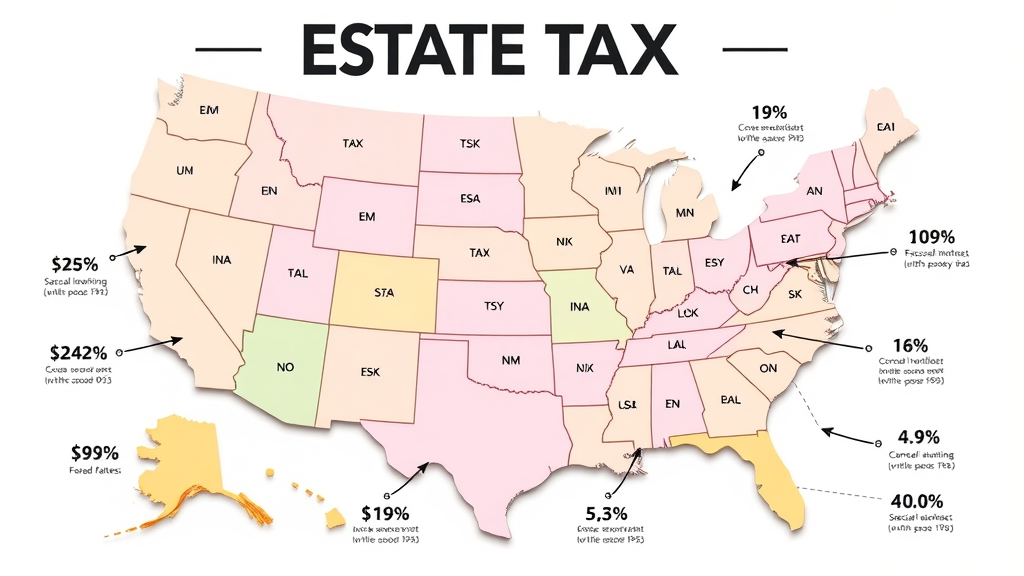

One of the most formidable obstacles to tax-efficient wealth transfer is the estate tax. The federal estate tax applies if your assets exceed certain thresholds at death, potentially costing heirs a significant portion of your legacy. In addition to the federal rate, several states impose their own estate or inheritance taxes, each with unique exemption limits and rates. Understanding state-specific rules is crucial, as an uninformed strategy can result in severe losses—especially if properties or beneficiaries span multiple states.

By comparing state estate tax rates and exemptions, families can make informed decisions about where and how assets are held. In some cases, relocating assets or trusts to more favorable jurisdictions can save families thousands—or even millions—over time. Below, a table highlights how state-by-state differences can impact your taxable estate and ultimate inheritance.

| State | Estate Tax Rate (%) | Exemption Amount |

|---|---|---|

| New York | Up to 16% | $6.58 million (2024) |

| California | None | N/A |

| Massachusetts | 0.8% – 16% | $2 million (2024) |

| Florida | None | N/A |

| Oregon | Up to 16% | $1 million (2024) |

Strategies for Tax-Efficient Wealth Transfer: Revocable and Irrevocable Trusts

One of the most powerful ways to achieve tax-efficient wealth transfer is through the use of trusts—specifically, revocable trusts, irrevocable trusts, and grantor trusts. These instruments can help you avoid probate, control how and when assets are passed, and—most importantly—reduce tax liability for your heirs.

Each trust type serves unique needs: revocable trusts offer flexibility and control during your lifetime, while irrevocable trusts often deliver stronger asset protection and tax savings. Advanced strategies can also include defective grantor trusts or grantor retained annuity trusts to unlock further efficiency for high-net-worth families. Let’s break down how each trust works to keep your estate plan ahead of the curve.

Using a Revocable Trust in Wealth Transfer Planning

A revocable trust—sometimes called a living trust—provides unmatched flexibility in terms of managing and distributing your assets while you’re alive and after your passing. You retain the ability to alter or dissolve the trust at any time, and it helps your heirs avoid probate, streamlining the wealth transfer process. From a tax standpoint, however, revocable trusts do not directly reduce estate tax because assets remain part of your taxable estate. Still, the administrative and privacy advantages make them a fundamental estate planning tool, particularly for complex family situations or multiple properties.

While revocable trusts have limited impact on gift tax or estate tax savings, they serve as an excellent foundation for more advanced strategies. By pairing them with other tools (like proper titling of assets and coordinated beneficiary designations), families can ensure assets pass swiftly, efficiently, and in alignment with their broader wishes for wealth planning and tax law compliance.

Maximizing an Irrevocable Trust for Tax Efficiency

When it comes to minimizing taxable estate and securing meaningful tax benefits, the irrevocable trust is a cornerstone for high-impact wealth transfer. Unlike a revocable trust, once established, an irrevocable trust can’t be modified easily. This means assets placed into the trust are removed from your estate, reducing your exposure to estate tax and—even better—potentially lowering your gift tax liability. For families with significant assets, strategically funding irrevocable trusts (such as life insurance trusts or charitable remainder trusts) can yield enormous savings.

Key tools like the grantor retained annuity trust (GRAT) and the intentionally defective grantor trust (IDGT) fall into this category, offering creative ways to transfer appreciating assets while “freezing” estate tax values for heirs. Proper trust drafting and coordination with your estate plan are critical to realize these advantages. Always consult an experienced advisor to maximize the opportunities within current tax law.

Grantor Trusts: Advanced Tax Techniques for Wealth Planning

For those seeking next-level tax-efficient wealth transfer, the family of grantor trusts—particularly intentionally defective grantor trusts (IDGTs)—offers advanced strategies. These trusts allow the grantor to be treated as the owner for income tax purposes but not for estate tax calculations. That means the grantor pays the income tax on the trust’s earnings, allowing the assets inside the trust to grow free of income tax burdens for future generations.

This approach is especially potent for transferring high-growth assets, closely-held businesses, or partnership interests. Other options, like the grantor retained annuity trust (GRAT) or grantor retained unitrust, can further reduce your taxable estate while minimizing gift tax exposure. By leveraging advanced trust structures, you can build a resilient legacy that thrives across generations—despite changing tax law.

Annual Gifts & The Power of Annual Gift Exclusions in Tax-Efficient Wealth Transfer

Annual gifting is a simple yet essential strategy in tax-efficient wealth transfer. The IRS allows you to give a set amount per recipient, per year, without incurring gift tax or using up your lifetime exemption. For 2024, this annual gift tax exclusion is $17,000 per recipient. Leveraging this exclusion across multiple family members each year can reduce the size of your taxable estate over time while also providing benefits when they’re most needed.

When paired with lifetime gifting strategies or education funding (like 529 plans), annual gifts provide a practical way to help family members while sidestepping immediate estate tax implications. Keeping careful records and coordinating with your advisory team ensures you don’t accidentally exceed exclusion limits, which could trigger unexpected IRS scrutiny or penalties.

How the Annual Gift Tax Exclusion Works

The annual gift tax exclusion empowers you to give up to the IRS limit ($17,000 in 2024) to as many people as you choose, every year, completely tax-free. Neither you nor the recipient pays gift tax on these amounts. Married couples can combine exclusions, doubling their giving power (up to $34,000 per recipient). This can be used for cash, stock, or other property.

The exclusion resets each calendar year—so strategic giving, especially over a decade or more, can dramatically shrink your taxable estate and maximize the wealth you pass on. Importantly, gifts below this threshold do not affect your federal lifetime gift exemption or estate tax exemption. Staying organized and utilizing the full value of these exclusions is central to any forward-thinking estate plan.

Practical Examples: Gifting Without Triggering Estate Taxes

Consider a family with two children and three grandchildren: utilizing the annual gift tax exclusion, each parent can give $17,000 to each relative annually, removing $170,000 from their estate each year (2 parents × 5 recipients × $17,000). Over a decade, that's $1.7 million transferred without ever touching the estate or gift tax radar.

You can also “gift split” with your spouse, or pay medical/tuition expenses for a family member directly to an institution—which don’t count toward your annual limits. These methods, if consistently used, set the stage for truly tax-efficient wealth transfer, leaving more for heirs and less for the IRS.

Transfer Tax Strategies: Minimizing Your Liability

The key to reducing transfer tax liabilities lies in integrating multiple tools—lifetime exemptions, charitable strategies, and trust vehicles—into one coordinated plan. By starting early and consulting professional advisors, families can unlock IRS-approved opportunities to pass assets on with minimal taxation and friction.

Strategic planning can ensure that you maximize your lifetime gift exemption, leverage the annual gift tax exclusion, benefit from tax-efficient charitable giving, and minimize your taxable estate through advanced trust arrangements. Each move must be carefully timed and documented for optimal results under ever-changing tax law.

Utilizing Lifetime Exemptions in Wealth Transfer

The lifetime gift and estate tax exemption lets you transfer a total amount (currently $12.92 million per individual in 2024) across your life and death, tax-free. Strategic lifetime gifts can be paired with annual exclusions to shrink your taxable estate while still providing for your loved ones now. But beware: when you pass, the IRS adds all gifts above the annual exclusion back into your total, so proactive planning is essential.

Effective use of your exemption can save your beneficiaries enormous sums in both federal and state estate taxes. Many families combine this approach with advanced trust vehicles (such as grantor trusts or retained annuity trusts)—allowing for even greater efficiency and security within your estate planning efforts.

Optimizing Charitable Giving for Estate and Transfer Tax Reduction

Charitable giving isn’t only about making a difference; it’s also a cornerstone for tax-efficient wealth transfer. By establishing a charitable remainder trust, donating appreciated assets directly, or using donor-advised funds, you can reap income tax deductions, reduce your taxable estate, and even receive income during your lifetime.

These strategies can be tailored for optimal impact: you might donate a valuable asset to charity, take an immediate deduction, and then structure the remainder to return income to your family. Coordinated correctly within your estate plan, charitable giving delivers powerful flexibility and satisfying legacy-building—while also creating major tax savings.

Transferring Wealth Across Generations: Preserving Family Legacies

Transferring wealth between multiple generations takes careful planning to avoid accidental taxes and ensure that values, not just money, are preserved. Modern estate planning considers the special role of the generation-skipping transfer tax (GSTT), ensuring that legacies continue and grow for grandchildren and beyond. Whether your goal is education, homeownership, or long-lasting financial security for your descendants, proactive steps today shape your family’s tomorrow.

In addition to sophisticated trusts and annual gifts, successful multigenerational wealth transfer places an emphasis on communication, shared values, and periodic reviews of the estate plan. Remember, the best plans are ones that adapt—protecting heirs even as circumstances, needs, and tax law shift over the years.

Generation-Skipping Transfer Tax: What Families Need to Know

The generation-skipping transfer tax (GSTT) applies when assets “skip” a generation—passing directly to grandchildren, for example. This law is designed to prevent excessive avoidance of estate tax by transferring wealth straight to younger heirs. Fortunately, the GSTT comes with its own exemption (currently $12.92 million per person), and with proper planning, you can structure trusts and bequests to sidestep double taxation.

If your family includes multiple generations or expects substantial transfers, integrating GST strategies into your estate plan is a must. Fail to do so, and you may lose out on significant amounts to taxes that could have instead bolstered family security for decades.

Techniques for Smooth Multigenerational Wealth Planning

Families who successfully steward wealth across generations implement a variety of savvy tactics: forming family limited partnerships, using dynasty trusts, and including education/training for beneficiaries. Every estate plan should include a process for updating documents, re-evaluating assets, and aligning trust terms with current tax law.

Collaboration is key. Bringing heirs into the planning process prepares them to receive, manage, and grow inherited assets—making the most out of each opportunity created by tax-efficient wealth transfer.

"The wealthiest families don’t just transfer money—they transfer structures and strategies designed to thrive in any tax environment."

Case Study Table: How Tax-Efficient Wealth Transfer Saved Real Clients Thousands

To illustrate the effectiveness of these strategies, consider several real-world cases where families protected their wealth through tax-savvy planning. The table below summarizes common situations and the solutions that delivered massive tax savings.

| Client Profile | Tax Problem | Strategy Applied | Estimated Tax Saved |

|---|---|---|---|

| Retired couple, $8M assets, 3 grandkids | Estate tax exposure in high-tax state | Irrevocable dynasty trust, annual gifts, asset relocation | $1.2M saved |

| Business owner, $15M estate | Gift and generation-skipping taxes | GRAT, intentionally defective grantor trust | $2.3M saved |

| High-earning professional, $4M assets | No estate plan, probate risk | Revocable trust, coordinated beneficiary designations | $210,000 saved |

People Also Ask: Expert Answers on Tax-Efficient Wealth Transfer

What is the best state to transfer wealth to?

Comparing State Tax Laws and Impacts on Wealth Transfer

States like Florida and California have no state-level estate or inheritance tax, making them popular for tax-efficient wealth transfer. States such as New York, Massachusetts, and Oregon impose substantial estate taxes, reducing inheritance for beneficiaries. If maximizing legacy is your priority, consider relocating assets or even changing residency to a no-tax state—after reviewing both income and estate tax implications with a professional advisor.

How to pass on wealth without inheritance tax?

Legal Methods and Trust Solutions for Minimizing Inheritance Tax

Effective techniques include forming irrevocable trusts, making maximum use of annual gift tax exclusions, direct payments of education and medical expenses, and carefully titling assets. For larger estates, vehicles like grantor retained annuity trusts or donor-advised funds can further limit taxable transfers. Each family’s situation is unique, so tailor your strategy to your asset types and state law.

How can you transfer money without getting taxed?

Annual Gift Exclusion, Tax-Free Transfers, and IRS Limits

The annual exclusion ($17,000 per recipient in 2024) lets you transfer money tax-free to unlimited recipients. Other tax-free options include direct payments for education or medical costs, or moving assets within trusts that fit IRS rules. Staying under these thresholds is the simplest way to avoid triggering gift tax or having gifts counted against your lifetime exemption.

How do the wealthy transfer money to their kids?

Strategic Use of Trusts, Life Insurance, and Family Limited Partnerships

Wealthy families employ a mix of trusts (grantor, irrevocable, or dynasty), family partnerships, and life insurance. Trusts help avoid probate, minimize estate tax, and protect assets from creditors or mismanagement. Life insurance proceeds are often structured to pass outside the taxable estate, while family limited partnerships can centralize management and facilitate tax-efficient wealth transfer across generations.

Top Ten Mistakes to Avoid in Tax-Efficient Wealth Transfer

- Ignoring state-specific estate tax law

- Missing annual gift exclusions

- Overlooking trusts as wealth transfer tools

- Failing to plan for generation-skipping transfer tax

- Underestimating transfer tax implications

- Neglecting to update wealth planning documents

- Improper use of revocable versus irrevocable trust

- Not leveraging grantor trusts for advanced tax savings

- Failing to involve professional advisors

- Missing opportunities for charitable transfer planning

FAQs on Tax-Efficient Wealth Transfer

What is tax-efficient wealth transfer?

Tax-efficient wealth transfer means using legal strategies—like trusts, annual gifts, charitable giving, and careful planning—to minimize taxes paid when transferring assets to heirs or charities. The goal is to maximize what your loved ones receive while reducing exposure to estate, gift, and transfer taxes.

Why is estate tax such a concern in transferring wealth?

Estate tax can claim up to 40% of your wealth before it reaches heirs. Without planning, your estate could face major tax bills, reducing how much your family inherits. Understanding and planning for estate tax is essential for anyone wishing to preserve and protect their legacy for future generations.

How often should I update my wealth planning documents?

Review and update your estate planning documents every 2–3 years or after major life events—like birth, death, marriage, divorce, or significant financial changes. This ensures your plan reflects current law and family needs, preventing costly mistakes or litigation later on.

Key Takeaways: Tax-Efficient Wealth Transfer

- Strategic planning is crucial for minimizing estate, gift, and transfer tax

- Trusts—including revocable, irrevocable, and grantor—are key tax law tools

- Annual gifts and charitable planning enhance transfer efficiency

- Keeping updated with tax law changes is essential for optimal results

- Professional guidance can save families thousands in taxes

Conclusion: Take Action Now for Tax-Efficient Wealth Transfer Success

Protect your wealth, secure your legacy, and minimize tax exposure—start planning today.

Speak to Our Wealth Planning Experts

Give us a call @ 1.877.776.6829 or visit our website Conciergetax.vip today

Sources

- IRS – Gift and Estate Tax

- Tax Foundation – State Estate & Inheritance Tax

- NerdWallet – Estate & Inheritance Tax Guide

- Forbes – Estate Planning Guide

No external links could be added.

Add Row

Add Row  Add

Add

Write A Comment